How Retirement Planning can Save You Time, Stress, and Money.

Wiki Article

How Retirement Planning can Save You Time, Stress, and Money.

Table of Contents6 Easy Facts About Retirement Planning ExplainedThe Basic Principles Of Retirement Planning Retirement Planning Fundamentals ExplainedRetirement Planning Things To Know Before You BuyWhat Does Retirement Planning Do?Unknown Facts About Retirement Planning

A 401(k) suit is additionally a much more cost-efficient method to offer a financial incentive to your employees, as your organization will certainly be paying much less in pay-roll tax obligations than if you supplied a conventional raise or bonus offer, and also the employee will certainly also obtain even more of the money because they won't have to pay supplemental revenue tax - retirement planning.As an example, 1. 5% might not sound like much, yet just a passion substances, so do costs. This money is instantly deducted from your account, so you may not quickly see that you might be saving thousands of bucks by relocating your possessions to a low-cost index fund, or changing suppliers to one with lower financial investment fees.

If you have particular pension where you can contribute with funds with taxes you have actually paid currently vs. paying taxes upon the withdrawal of the funds in retirement, you may wish to think of what would conserve you a lot more in tax settlements with time. If you have certain much shorter term financial investment accounts, consider just how much cash you 'd spend there (and ultimately pay tax obligations on in the close to future) vs.

Retirement Planning Can Be Fun For Everyone

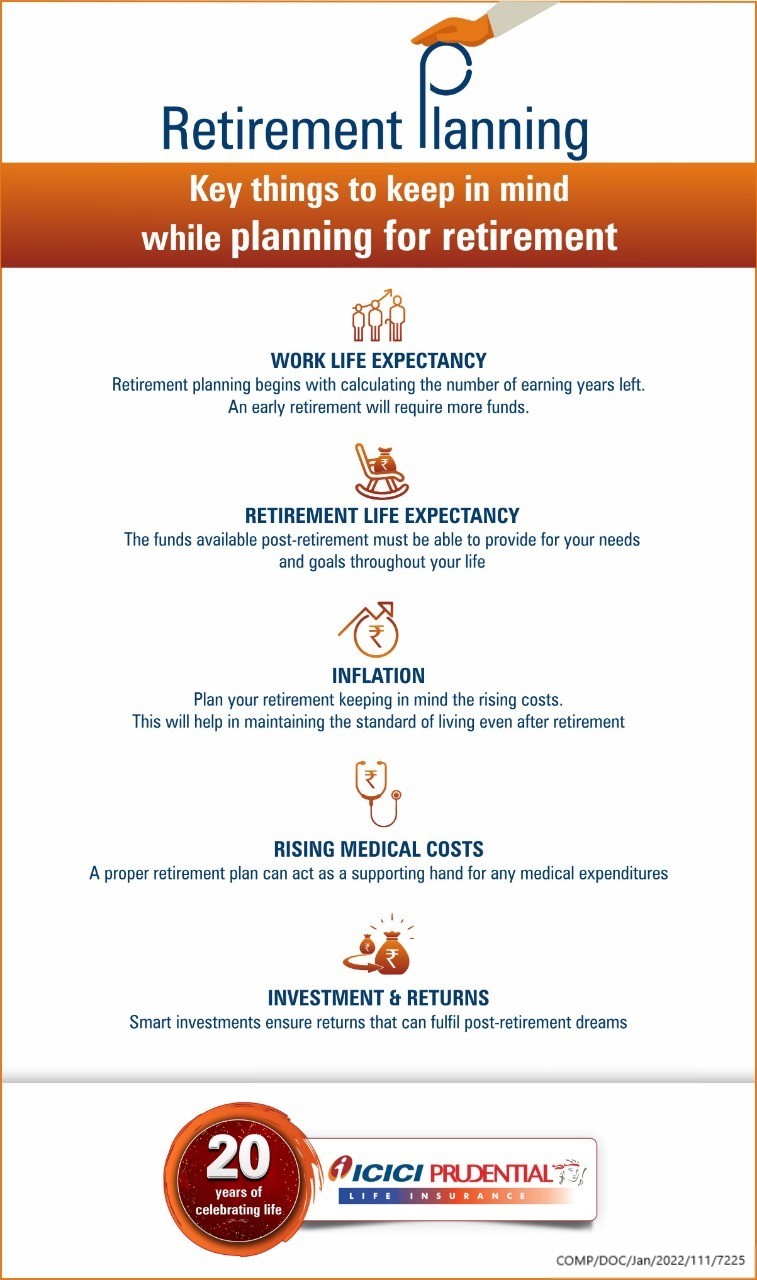

We believe that rather of really feeling the pinch post-retirement, it's reasonable to start saving early. What you simply require to do is to begin with an obtainable saving, plan your investments and also with a lasting commitment. The means you want to spend your retired life entirely depend upon the quantity of money you have actually saved as well as spent.

The Basic Principles Of Retirement Planning

Fulfilling their hefty clinical expenses as well as various other demands along with individual family need is really extremely challenging in today's period of high inflation. retirement planning. It is suggested to begin with your retired life cost savings as early as you are 20 years old and also solitary. The senior citizens present a substantial burden on their family members who had actually not prepared and also saved for their retirement.There's constantly a health and wellness issue linked with growing age. There may be a scenario where you can not function any longer and the cost savings for retired life will certainly help to guarantee that you are well cared of. web link So the huge inquiry is that can you manage the cost of long-term care because it can be really expensive and is included in the expense of your retirement.

Do you desire to maintain functioning after your retired life? If the solution is no, after that you should begin with your cost savings. The individuals that are not really prepared for retirement often have to keep working to fulfill their family's need throughout life. It is very unlikely that you will certainly create revenue forever, thus, cost savings play a vital duty.

Getting My Retirement Planning To Work

Nonetheless, if you begin late, it may occur that you have to compromise or adjust on your own with your pre-retirement and also retirement way of living. The quantity that you need to save and also include each period will certainly depend upon just how early you start conserving. Beginning with your retirement preparation in the twenties may seem also early for your retired life.

Additionally beginning early will allow you to establish excellent retired life financial savings as well as preparing habits as well as give you more time to rectify any kind of mistake as well as to identify any type of deficiency in accomplishing your goal.: Capture up on your Retired life Preparation in your 50s The retirement should be developed view it and carried out as quickly as you start functioning.

These economic organizers will certainly take into consideration various variables to perform retirement analysis that includes your web earnings, expenses, age, wanted retired life lifestyle and so forth. Employ the sweat of your gold years to give a color in your old days so that you depart the world with the sensation of complete satisfaction and completeness.

Some Known Details About Retirement Planning

There is a common misconception amongst young staff members, as well as it typically appears something like, "I have plenty of time to plan for retirement. There's no requirement to thrill." Others believe, "As quickly as I get my finances sorted, I'll begin believing about retired life." 1. If you wait for the "perfect" or "ideal" time, you'll never ever start.

With these 2 concepts in mind, workers can be urged to plan for retirement promptly. Neither their age neither their present financial resources ought to come in the means of retirement planning.

The Best Guide To Retirement Planning

Most of us put things off in some cases even the most efficient individuals, evidently! When it comes to saving for retired life, hesitating is not advised. Early risers do not just get the worm - they obtain 5 celebrity buffets for nearly no effort. Let's show the expense of procrastination with a tale of 3 imaginary pairs.For example, based on information from the Office for National Statistics they had 6,444 of non reusable income per head in 1977. In 1982, they had 7,435 of disposable income per head. By 1987, they had 8,565 These couples are just the same age The vital distinction between them is, they didn't all start to conserve for their retirements at specifically the very same time.

They determined to save 175 per month (2,100 per year). It would certainly have stood for 16. 29 percent of their annual revenue. They got affordable mutual funds, placing 70 percent of their money in supplies, 30 percent in bonds. The pair's funds matched the returns of each particular market. To put it simply, and for this image only, their stock market mutual funds matched the S&P 500.

Report this wiki page